Greetings fellow stinker thinkers,

Welcome to The Porcelain Post, your exclusive newsletter to a world of whimsical wonder and enlightening insights! We are absolutely flushed with excitement to have you join our cheeky community. So, fasten your seat belts, and get ready to embark on a porcelain journey like no other!

Today we delve into three critical aspects that are shaping the economic climate and influencing our daily lives. As we continue to navigate the uncharted waters of our economic landscape, it is essential to stay informed about the key figures that are significantly impacting our financial well-being. Now, we aren’t going to wear a cardboard box, ring a bell, and yell, “THE END IS NEAR.” No one can accurately predict when shit will hit the fan but it doesn’t hurt to be fearful when others are greedy. Let’s dive in on student loans resuming, soaring housing unaffordability, and projected corporate bankruptcies.

This is a nonpartisan and unbiased view, providing fair and balanced insights.

1) The Looming Shadow of Student Loans Resuming

For the last 3 years, the freeze on studently loan payments has created an excessive amount of consumer spending power. The average American was able to save and spend in a way they had been able to. Recently The Supreme Court ruled that the student loan forgiveness executive order is unconstitutional and would require action from congress. Payments are expected to resume in October of 2023 but will begin to accrue interest as soon as September 1st.

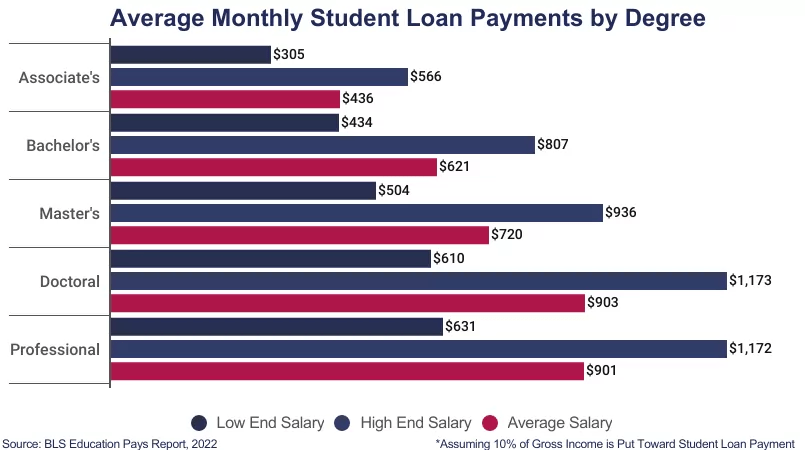

The BLS Education Pays Report collects data from various governmental agencies (federal and state). The average monthly payment for the graduating class is estimated to be around $503 a month. In the chart below we’re able to see the expected payment per the degree. Student loan borrowers are now facing the pressing reality of making monthly payments, diverting a considerable portion of their income to service debt. This hampers their ability to engage in discretionary spending, from purchasing goods to investing in services that drive economic growth. The resumption of student loan payments poses a challenge not only for borrowers but also for policymakers aiming to foster a robust financial environment.

2) Housing Market: Reaching Unprecedented Levels of Unaffordability

The dream of homeownership has become increasingly elusive for many as the housing market reaches its highest levels of unaffordability since the 2008 financial crisis. According to a report by Fortune, prospective homeowners are now taking on high mortgages to secure a place to call their own. The rapid surge in interest rates has resulted in a mismatch between income and housing costs, putting homeownership out of reach for a significant portion of the population.

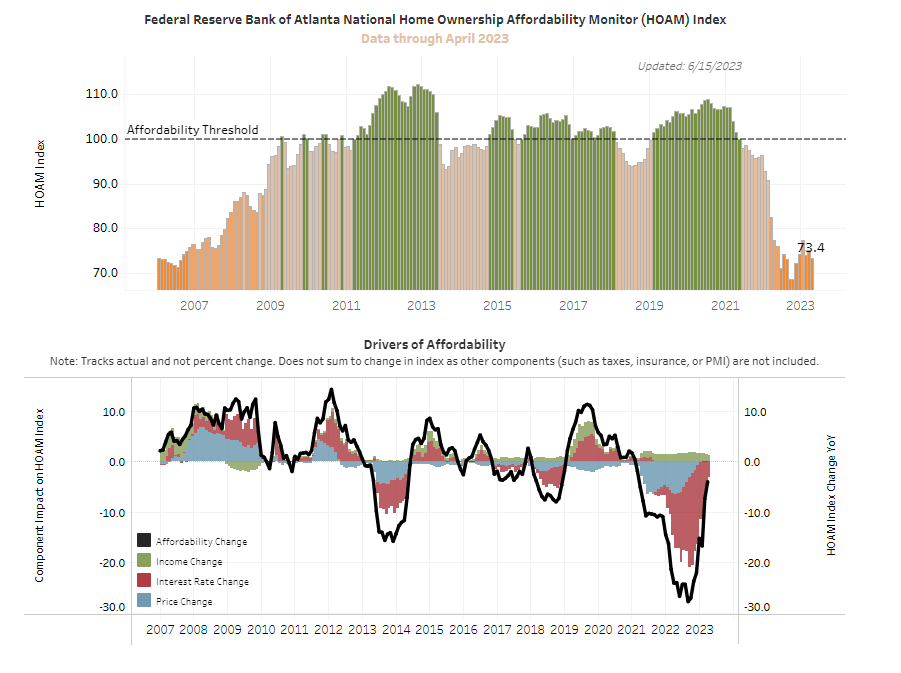

The Federal Reserve Bank of Atlanta tracks the Home Ownership Affordability Monitor Index (HOMA). This is a lagging indicator as it doesn’t reflect monthly prices changes for May and June. Per the chart below, the average home would cost about $3,400 a month (excluding utilities). Someone making $100K a year would struggle to get approved for the mortgage let alone afford the payment. The increasing unaffordability in the housing market has far-reaching implications on individuals and families. Rising home prices not only impact potential buyers but also have consequences for the rental market, as demand for affordable rental housing rises.

| Home Value | $400,000 |

| Down-payment | $20,000 |

| Interest Rate (as of 7/21/2023) | 7.8% |

| Expected Monthly Payment | $3,400 |

3) Exponential Increase in Corporate Bankruptcies Looms

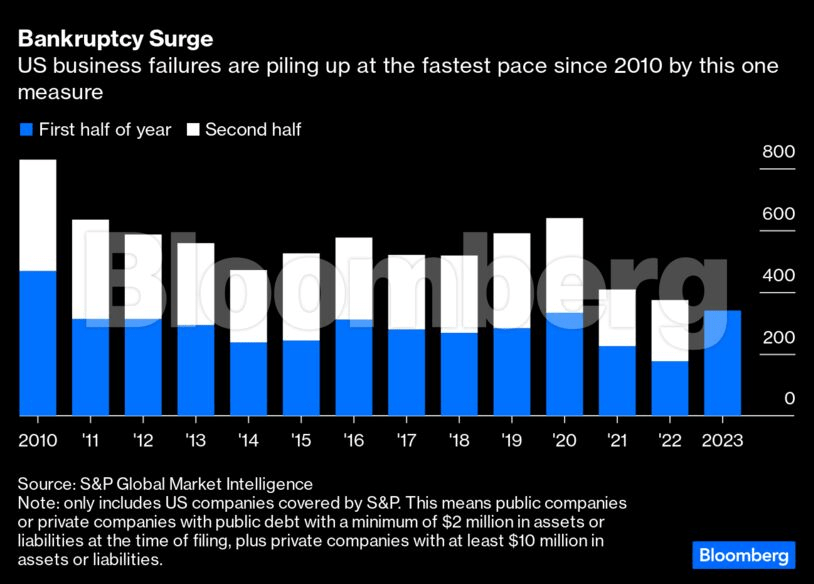

An insightful article on Advisor Perspectives highlights a grim forecast for corporate bankruptcies, projected to reach levels not seen since the 2008 financial crisis. With economic uncertainty prevailing and mounting debt burdens, companies across various sectors are struggling to stay afloat. As debt levels soar, distressed firms face an uphill battle to restructure and avoid the dreaded path of bankruptcy. The chart below highlights the increase in US bankruptcies but we’re also seeing an unprecedented increase across the EU.

The specter of corporate bankruptcies carries significant ramifications for employees, investors, and the overall health of the economy. Job losses, disrupted supply chains, and the potential domino effect on other businesses can create a ripple effect that impacts multiple sectors. Investors, too, face uncertainty as they grapple with the possibility of loss in their investment portfolios.

The Final Flush

Now what does this mean for you – the average Loo Lounger? The news may sound grim but it shouldn’t stop you from enjoying your life. It doesn’t hurt to save as much as you can but just be weary of how these creeping expenses can destroy your budget. While we may have only grazed the surface of these topics – we plan to revisit them over the coming weeks. Thank you for being part of our community. Stay tuned for more updates in our upcoming newsletters. Before you go, don’t forget to wipe and flush!

Taking care of business,

The Throne Master

Leave a comment